Investment and economic outlook, March 2025

.

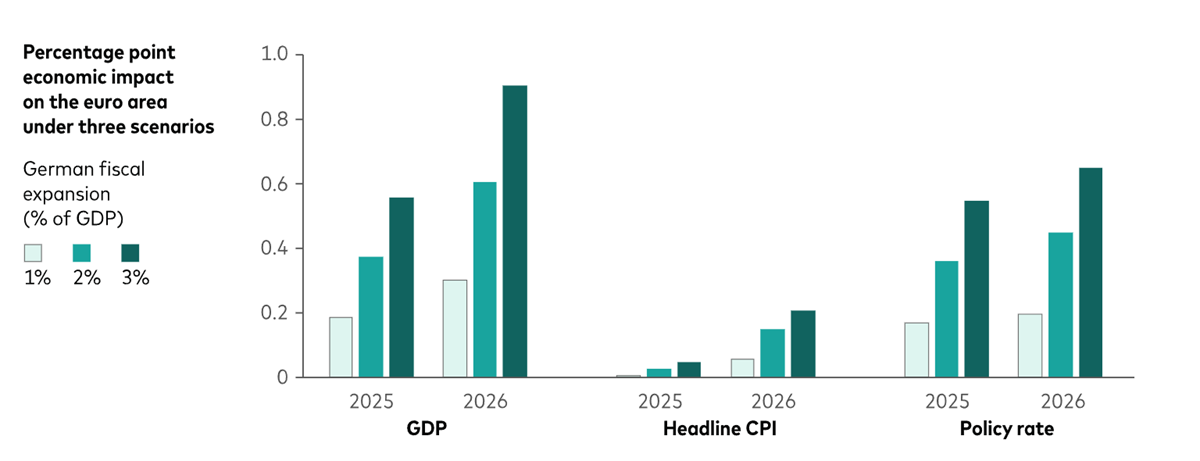

The government of Germany, home to the euro area’s biggest economy, this month approved its largest fiscal spending increase in more than a generation. Headlined by a €500 billion infrastructure investment fund, the fiscal package could boost euro area economic growth and inflation and lead to a higher European Central Bank (ECB) policy interest rate.

Germany's fiscal plan could significantly affect euro area growth, inflation and monetary policy

Notes: The chart shows the modeled impact on euro area macroeconomic fundamentals under three German fiscal expansion scenarios, including the fiscal deficit widening by 1% of GDP, 2% of GDP, and 3% of GDP. GDP refers to the estimated cumulative impact on the level of euro area GDP by year-end 2025 and 2026. Headline consumer price index (CPI) refers to the average annual headline CPI rates. Policy rate refers to the ECB deposit facility rate by year-end.

Sources: Vanguard calculations, based on data from Bloomberg and Oxford Economics, as of 10 March, 2025.

In addition to Germany’s fiscal package, which includes an exemption from the nation’s rule against spending more than 1% of GDP on defense, increases in defense spending across Europe and the prospect of a ceasefire in Ukraine lead us to increase our forecasts for euro area economic growth, inflation, and the ECB policy rate.

Financing for the plan may significantly increase the supply of government-backed debt, as discussed in an analysis by Roger Hallam, Vanguard global head of rates, and Shaan Raithatha, Vanguard senior European economist. The plan unlocks “billions of euros in spending that could help kick-start Germany’s flagging economy, which has been contracting for more than two years,” the pair write.

Outlook for financial markets

We have forecasts for the performance of major asset classes, based on the 31 December, 2024, running of the Vanguard Capital Markets Model®. Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Australian dollar investors

Australian equities: 4.5%–6.5% (21.8% median volatility)

Global equities ex-Australia (unhedged): 4.1%–6.1% (18.8%)

Australian aggregate bonds: 4.1%–5.1% (5.6%)

Global bonds ex-Australia (hedged): 4.4%–5.4% (5.0%)

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Source: Vanguard Investment Strategy Group.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are as of 31 December, 2024. Results from the model may vary with each use and over time.

Region-by-region outlook

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of March 20, 2025.

Australia

Australia's economy has shown resilience, avoiding recession despite aggressive monetary tightening by the central bank.

We expect:

- A gradual recovery in 2025, with full-year economic growth of about 2%, supported by rising real household incomes, a rebounding housing market, and rate-cut expectations.

- A tight labor market, government energy and rent subsidies, and external uncertainties to preclude sharp disinflation this year. In January, headline inflation remained steady at 2.5% year over year. Trimmed mean inflation, which excludes extreme items, rose to 2.8% year over year.

- The unemployment rate to rise to about 4.6% this year—it stood at 4.1% in February—as financial conditions tighten amid still-restrictive interest rates.

- The Reserve Bank of Australia to proceed cautiously with further rate cuts due to sticky services inflation. We forecast the cash rate target will end 2025 at 3.5%.

United States

Uncertainty around tariffs, immigration, and other policy is likely to weigh on the economy in 2025. Real-time signals point to a material slowing of growth in the first quarter. In its March 18 GDP Now estimate, the Federal Reserve Bank of Atlanta anticipated a first-quarter economic contraction.

Increased policy uncertainty has prompted us to downgrade our 2025 U.S. growth forecast and to raise our inflation forecast.

We now expect:

- Full-year 2025 economic growth of 1.7%, down from 2.1%.

- The core rate of inflation, which excludes food and energy prices due to their volatility, to register about 2.7% this year, up from our previous forecast of 2.5%, based on the Fed’s preferred inflation measure, the Personal Consumption Expenditures price index.

- A considerably softer labour market report for March than we’ve become accustomed to. The report will reflect recently announced government layoffs, and we expect little employment growth in private-sector industries that are sensitive to government spending. Tariff uncertainty likely has curbed hiring in construction and manufacturing.

- The Federal Reserve to cut its target for short-term interest rates twice in the second half of the year, to a range of 3.75%–4% at year-end. The current target is 4.25%–4.5%.

Canada

Trade and tariff uncertainties have prompted us to revise our forecasts for Canadian economic growth, unemployment, core inflation, and the policy rate set by the Bank of Canada.

We now expect:

- Full-year 2025 economic growth of 1.3%, down from 1.8%.

- The Bank of Canada to trim its policy interest rate by year-end to 2.25%. We previously forecast a terminal rate of 2.5%. The central bank’s target is currently 2.75%.

- Full-year core inflation of 2.4%, up from 2.2%, reflecting our expectation for a relatively modest tariff regime.

- The unemployment rate to rise from 6.6% to 7% by year-end due to trade-related uncertainty.

Euro area

A major infrastructure and defense program announced by Germany’s new government is set to increase the nation’s fiscal spending, leading us to upgrade our euro area growth and inflation forecasts and our European Central Bank (ECB) policy rate view.

We now expect:

- Economic growth in 2025 of 1%, up from our previous forecast of 0.5%, and a 1.6% expansion in output next year, up from our previous forecast of 0.8%. Significant tariffs on U.S. imports of European Union goods for an extended period could largely offset the gains from expansionary fiscal policy in 2025 and 2026.

- The headline and core rates of inflation to end 2025 below 2%, though we have lifted our estimate of core inflation for 2026 by 0.2 percentage point to 2.1%.

- One final interest rate cut by the European Central Bank, which would bring its deposit facility rate to 2.25%. We previously forecast a terminal rate of 1.75%

- The unemployment rate to rise only modestly, instead of the previously forecasted gradual rise to near 7% in 2025, from the current record low of 6.2%

United Kingdom

The economy of the United Kingdom recently has been characterised by sluggish growth and moderating but elevated price and wage pressures. On March 20, the central bank’s policymakers maintained their 4.5% target interest rate, noting a gradual approach to further monetary policy adjustments.

We expect:

- Economic growth this year of 0.7%, down from our previous forecast of 1.4%, reflecting base effects from late 2024 and deteriorating forward-looking data.

- The headline rate of inflation to rise toward 3.5% in the near term due to higher energy prices but to fall to about 2.5% by year-end. The core inflation rate is likely to fall to about 2.7% by year-end.

- The unemployment rate to end the year around 4.7%, up from 4.4% for the November-through-January period, reflecting recent signs of labor market softening.

- The Bank of England to reduce its policy interest rate from 4.5% to 3.75% by year-end.

Japan

Recent economic conditions in Japan have been marked by a strengthening wage-price spiral and a gradual recovery in private consumption, which is expected to continue in 2025.

We further expect:

- Economic growth in 2025 of 1.2%, supported by upward momentum in wages. The impact of global economic uncertainty, such as potential U.S. tariff hikes, is expected to be limited, with positive spillover from policy stimulus in China.

- Steady wage growth and structural labor shortages to keep the “core" rate of inflation, which excludes fresh food and energy, robust at about 2% this year.

- The country’s structural labor shortage, which has been partially alleviated by increased labor force participation from women, older people, and foreign workers, to continue exerting upward pressure on wages.

- The Bank of Japan to gradually raise its current 0.5% policy rate to 1.0% by year-end.

China

China's economy has appeared robust in the first quarter of 2025, but underlying headwinds suggest slower growth for the rest of the year.

We expect:

- Full-year economic growth of about 4.5%, a bit less than the growth target of “about 5%” set for the third consecutive year by the National People’s Congress. An April Politburo meeting will be a key indicator of whether policy shifts to boost consumption.

- A core rate of inflation of about 1.5% in 2025. Supply-centric policies have reinforced a negative feedback loop between weak demand and low prices.

- The unemployment rate—5.4% in January–February—to finish 2025 around 5%.

- Monetary policy adjustments aimed at boosting growth—specifically, a 0.3 percentage point cut to the seven-day reverse repurchase rate and 0.5 percentage point of cuts to banks' reserve requirement ratios.

Emerging markets

Recent economic conditions in emerging markets have been mixed. Mexico's economy contracted by 0.6% in the fourth quarter of 2024, and inflation remains a concern, while Brazil has seen a significant rise in inflation, leading the central bank to raise its policy interest rate to 14.25% to combat rising prices.

In Mexico, we expect:

- That economic growth could slow below our 1.25%–1.75% baseline for 2025 if significant tariffs are implemented and sustained.

- The core rate of inflation to fall to 3.25%–3.5% in 2025, above the midpoint of Banxico’s 2%–4% target range. It registered 3.65% year over year In February.

- The easing cycle at the Bank of Mexico (Banxico) to continue, with its policy rate ending 2025 in a range of 8%–8.25%. It is 9.5% today.

Notes: All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

By Vanguard

26 March

vanguard.com.au